Discover why lingerie is one of the hardest garments to make and how Deepwear helps fashion brands source, engineer, and manufacture high-quality lingerie with precision, comfort, and sustainability.

When it comes to apparel, few categories are as demanding as the lingerie manufacturing process. A bra or bralette may look simple, but behind the seams lies a precise balance of engineering, aesthetics, and skilled craftsmanship. Lingerie must sit directly on the skin, provide support, move with the body, and still look beautiful — making it one of the most complex garments to produce.

At Deepwear, we understand the technical, supply-chain, and business challenges of intimate apparel production. From delicate fabrics and specialised machinery to multi-layer construction and unforgiving fit, every step requires care and precision.

In this blog we cover:

- Why lingerie manufacturing is one of apparel’s most technically demanding categories.

- The role of fit, materials, and skilled labour in creating high-quality lingerie.

- The leading lingerie production hubs across Asia, Europe, and the Americas.

- How geographic advantages — from nearshoring in Mexico to premium production in Turkey — can influence cost and speed-to-market.

Why lingerie is one of the hardest garments to make

Lingerie looks effortless on the hanger. Up close, it’s an assembly of delicate fabrics, engineered foam, tiny hardware, and fine elastics. Getting those elements to work together is where the real difficulty begins. At Deepwear, we understand these challenges and support brands by developing designs, sourcing materials, and overseeing production in ways that keep projects moving smoothly. But why exactly is lingerie complex to make? Below are some reasons why:

- Fit is unforgiving: A dress can hide a poor dart. Lingerie cannot. It must fit directly against bare skin and support the body without discomfort. A bra’s fit depends on three interacting systems: the band for anchoring, the cup for shaping, and the straps for lift. Change one and the others change too. This interdependence creates a sizing matrix — not a simple linear scale — and makes grading across sizes a non-linear, detail-heavy process. Deepwear can provide grading and measurement support so brands can launch collections that perform well across markets.

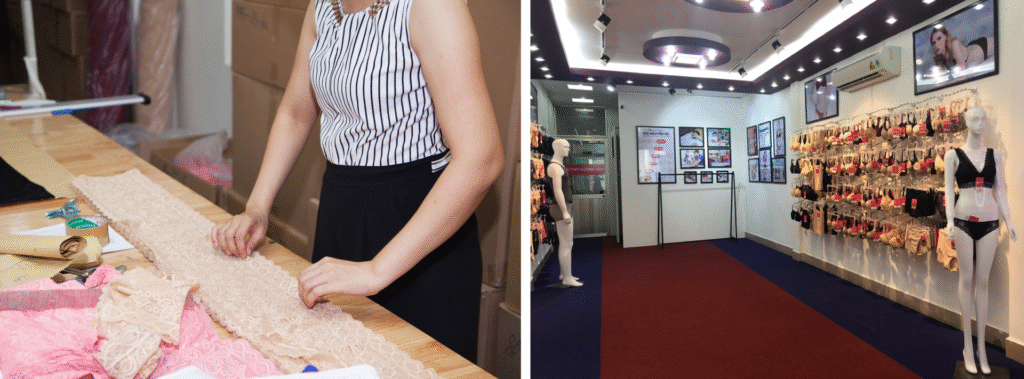

- Materials behave differently and demand respect: Common lingerie materials include lace, mesh, powernet, microfiber, bonded foams, elastics, and underwires. Each has its own stretch, recovery, thickness, and hand. Laces can be directional and fragile; foam can delaminate during heat processes; elastics can lose recovery if sewn under incorrect tension. The technical labor often comes down to making incompatible materials behave like a single, cohesive fabric. Deepwear can assist brands in sourcing compatible materials to ensure smooth intimate apparel production.

- Multi-layer construction and tiny tolerances: A typical bra may contain a face fabric, lining, foam or padding, underband, elastics, and hardware. These layers must align precisely, often to millimetres. Underwire channels require exact sewing so wires don’t migrate. Seams, scallops, and motifs need matching. Small mistakes quickly become visible and costly. By working with specialised lingerie factories, Deepwear can reduce rework and protect quality.

- Skilled labor and specialised machinery: Lingerie assembly uses a range of machines — zigzag, coverstitch, flatlock, ultrasonic welders for bonded styles, underwire insertion units, and foam-moulding equipment. Beyond machines, experienced operators are essential: sewing delicate stretch fabrics without puckering, inserting wires without damaging foam, and finishing fine edges require years of practice. Deepwear connects brands with skilled operators and trusted partners equipped for lingerie production.

Looking to partner with factories that understand lingerie’s precision and artistry? Deepwear’s consultants can help your brand source certified materials and skilled production partners for beautiful, compliant, and scalable collections.

- Prototyping loops raise cost and lead time: From sketch to production-ready piece typically takes multiple physical samples: toile, prototype, wear-test, and pre-production. Virtual tools help, but physical wear tests usually reveal issues that paper or CAD cannot. That iterative process increases upfront cost and lead time — a particular pain point for smaller brands. Deepwear can help manage sampling and prototyping so timelines and budgets stay realistic.

- Quality control, testing, and safety: Lingerie must pass tests for elastic recovery, hook-and-eye durability, underwire migration, and wash resilience. Failure in any of these areas often results in returns and reputation damage. There are also compliance rules in certain markets — material restrictions, labeling, and sometimes flammability standards — which add documentation burdens across component suppliers. Deepwear can oversee testing and compliance to help brands meet standards in their target markets.

- Sourcing complexity and colour matching: A single design can involve lace makers, elastic producers, hardware houses, foam mounters, and multiple fabric mills. Each supplier brings minimum order quantities and lead times. Dye lots must match across different suppliers — a small mismatch can make a set look off. That reality forces either larger inventory commitments or frequent reworks. Deepwear can support supplier coordination and colour matching early in the process to minimise delays.

- Cost pressure versus expected quality: High-quality lingerie requires skilled labor and fine materials, and that raises the cost of goods sold. Consumers expect beauty and affordability. Balancing that expectation with the real cost of doing lingerie well is one of product teams’ hardest decisions. Deepwear can offer costing guidance that helps brands stay competitive without cutting corners on quality.

- Design compromises — but lingerie can (and should) be beautiful: Designers want sheer cups, invisible seams, and delicate silhouettes. Engineers need structure, secure attachments, and seams that give support. The best outcomes come from teams that balance both: they engineer ways to deliver the look without sacrificing performance. Unlike many other garment types, lingerie isn’t just practical; it can also be beautiful. That dual purpose — functional performance plus aesthetic value — raises the bar. Deepwear can support design translation so creative ideas become manufacturable garments.

- Cheap lingerie may be more than poor quality — it can cause harm: Using low-cost materials and inadequate manufacturing processes is not merely a quality issue; it can carry health risks. Harsh chemical finishes, poorly cured adhesives, non-compliant hardware, and low-grade elastics can cause skin irritation, contact dermatitis, or allergic reactions. Poorly finished seams or wires that migrate can cause chafing or small injuries. In extreme cases, substandard materials can harbor irritants or residues that exacerbate pre-existing skin conditions. This is why responsible sourcing, certified materials, and proper testing are non-negotiable when launching a lingerie line. Deepwear can help brands access certified materials and safe production partners.

- Sustainability and circularity are difficult but important: Lingerie’s multi-material assemblies and bonded constructions complicate recycling. Sustainable alternatives — mono-material designs, recycled yarns, biodegradable trims — exist, but they often increase cost or require curated supplier relationships. Brands committed to sustainability usually need to rethink construction and supplier selection from the outset. Deepwear can introduce brands to lower-impact fabrics and suppliers suited for lingerie development.

- Emerging tech helps but doesn’t replace hands-on expertise: 3D scanning, body-mapping knit, and seamless knitting can reduce seams and improve fit, but adoption needs investment. Many fit issues still require hands-on pattern tweaks and wear tests. Technology shortens some loops but doesn’t eliminate the need for skilled production partners. Deepwear can help integrate new technology alongside proven methods, so brands benefit from both innovation and reliability.

Want to understand how sizing and fit impact lingerie production? Explore our guide on Measurements, Grading, and Sampling to see why a solid foundation is essential before you even think about mass manufacturing.

Where Good Lingerie is Made

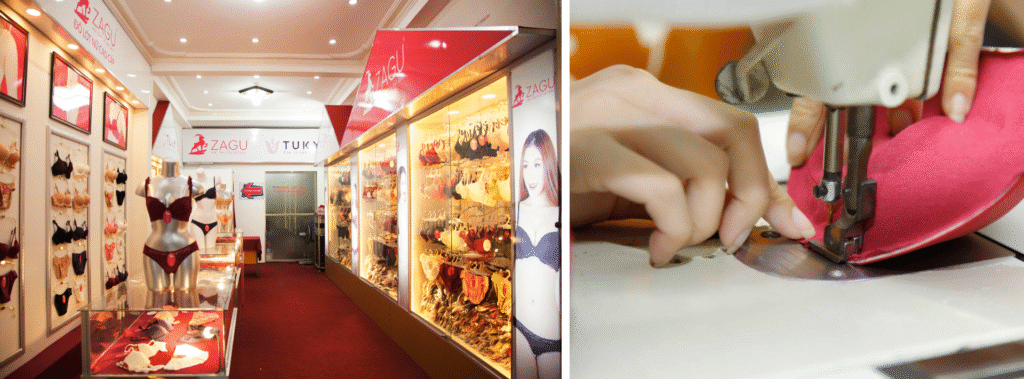

Behind every bra, bralette, or shapewear is a highly specialized supply chain. Unlike basic garments, lingerie requires multiple trims, precision sewing, and delicate materials that only certain hubs around the world have mastered. At Deepwear, we connect brands to these hubs and help them choose the right one based on cost, quality, and geography. Here’s a closer look at the leading markets for lingerie manufacturing:

1. China: China remains the world’s largest lingerie hub, with clusters like Gurao in Guangdong producing everything from lace bras to moulded cups at scale. Factories here have the widest access to trims, underwires, foam, and lace, making it the go-to for both basics and engineered lingerie.

- MOQ: 1,000–3,000 units (bras); 1,000-2,000 units (panties/bralettes)

- Why it works: Complete supply chain integration — everything from moulded cups to lace can be done in one place.

- Watch out for: Rising labor costs and stricter ESG requirements from Western buyers.

2. Vietnam: Vietnam has grown into a trusted partner for brands seeking higher-quality lingerie with strong compliance standards. Most factories specialize in mid-range bras and panties, balancing workmanship with cost efficiency.

- MOQ: 1,000–2,000 units

- Why it works: Good balance of quality, compliance, and reliable exports.

- Watch out for: Dependence on imported fabrics and trims (often from China) can add to lead times.

3. India: India’s strength lies in its textile base, offering competitive pricing for cotton and knit lingerie. It’s a good hub for panties, bralettes, and simpler designs.

- MOQ: 1,000 – 1500 units (panties/bralettes); 2,000–3,000 (bras)

- Why it works: Strong local fabric sourcing keeps prices competitive.

- Watch out for: Limited specialization in high-tech moulded or engineered bras.

4. Turkey: Turkey serves as a premium sourcing base, especially for European brands. Factories are skilled in lace, embroidery, and luxury lingerie, with shorter shipping times to EU markets.

- MOQ: 800–1,500 units

- Why it works: Proximity to Europe and craftsmanship in premium styles.

- Watch out for: Higher energy and labor costs compared to Asia, plus some geopolitical instability.

5. Mexico: Mexico has become a rising option for US brands looking for faster turnaround and nearshoring benefits. It works well for smaller collections, capsules, or replenishment orders.

- MOQ: 500–1,000 units (panties/bralettes); 1,500–2,000 (bras)

- Why it works: Shorter delivery times and reduced freight costs to the US.

- Watch out for: Tariffs and USMCA rules of origin must be considered in final costing.

While some sources suggest lingerie can be made in runs as small as 200–500 pcs, this is usually only true for very simple styles (panties or bralettes made from stock trims). Custom-engineered bras with moulded cups and specialized lace nearly always require 1,000–3,000 pcs due to trim supplier MOQs.

6. Thailand: Thailand has a long-established lingerie manufacturing industry which produce for both domestic and international markets. Factories here combine skilled craftsmanship with regional supply-chain integration, serving brands across Asia and beyond.

- MOQ: 800–1,500 units (panties/bralettes); 1,500–2,000 (bras)

- Why it works: Experienced operators, solid infrastructure, and strong regional logistics make Thailand ideal for brands seeking quality production with mid-range costs.

- Watch out for: Some dependence on imported lace and trims can extend lead times, and labor costs are higher than in low-cost ASEAN countries.

7. Portugal: Portugal is a go-to European hub for premium and sustainable lingerie. There are factories here that specialize in high-quality, small-to-medium batch runs, focusing on craftsmanship, ethical production, and modern designs.

- MOQ: 500–1,000 units

- Why it works: Skilled artisans, shorter shipping times within Europe, and strong sustainability credentials make Portugal ideal for luxury or eco-conscious brands.

- Watch out for: Higher production costs than Asian hubs and smaller-scale capacity may limit ultra-large runs.

8. Morocco: Morocco is an emerging lingerie manufacturing destination primarily because of its proximity to Europe and growing textile infrastructure make it increasingly attractive for nearshoring.

- MOQ: 800–1,500 units

- Why it works: Strategic location near Europe, competitive costs, and government support for the textile industry make Morocco a strong alternative for EU-bound production.

- Watch out for: Supply-chain maturity is still developing, and trims may need to be imported from Asia.

At Deepwear, we help brands navigate these realities, finding the best-fit factory and negotiating the most efficient MOQ for each collection.

Why Is Lingerie One of the Hardest Garments to Manufacture?

Lingerie combines engineering, aesthetics, and craftsmanship. Each piece requires perfect fit, delicate fabrics, multi-layer construction, and expert labor to ensure comfort, beauty, and durability. These challenges make lingerie one of the most technically demanding categories in fashion production. Deepwear supports brands by guiding material sourcing, grading, and factory selection to ensure precision and quality from the first sample to mass production.

The Bottom Line

Each country brings unique strengths to lingerie production. China leads in scale and supply-chain integration, while Vietnam balances quality and cost with dependable compliance standards. India offers affordability and strong textile sourcing, whereas Turkey provides premium craftsmanship and quick access to European markets. Mexico continues to grow as a nearshoring hub for the US, valued for its flexibility and speed. Thailand adds skilled labor, reliable infrastructure, and a mature lingerie manufacturing base in the ASEAN region. Portugal stands out in Europe for sustainable, small-batch, and luxury production, ideal for brands seeking high-quality craftsmanship with ethical credibility. Meanwhile, Morocco is quickly emerging as a cost-effective nearshore option to Europe, with expanding textile investments and growing expertise in intimate apparel.

Making lingerie is a balance of art, engineering, and supply-chain precision. From millimetre-perfect construction to sourcing delicate materials, it’s one of the most complex categories to execute well. But with the right manufacturing hub and our guidance, brands can launch lingerie that delivers on both fit and beauty.

Whether you’re launching your first intimate line or scaling an existing range, our team can help you balance cost, quality, and geography to get your lingerie right.

Ready to create lingerie that blends craftsmanship, comfort, and confidence? Book a strategy call with Deepwear’s lingerie experts or explore our global intimate apparel manufacturing network today.