Discover how smart glasses evolved from prototypes to functional, stylish wearables. Learn how Deepwear helps fashion and tech brands design, source, and manufacture innovative eyewear globally.

Smart glasses have moved from awkward prototypes to stylish, useful wearables in just over a decade. What began as Google’s bold but premature Project Glass has transformed into a diverse market that mixes augmented reality (AR), audio, health sensors, and fashion — led today by collaborations between tech firms and eyewear brands (Ray-Ban + Meta, Snap, Vuzix, and others). Improvements in optics (waveguides), microprojectors, low-power AI, and miniaturized batteries — plus more attractive industrial design — are making smart glasses manufacturing a realistic product pathway for both consumers and enterprises.

In this blog we cover:

- The history and evolution of smart glasses, from early prototypes to AI-powered eyewear.

- Key lessons for modern brands on combining design, functionality, and usability.

- How Deepwear supports brands with material sourcing, prototyping, and end-to-end manufacturing across Asia.

- Strategic insights on where to manufacture smart glasses and the advantages of different production hubs.

- How Deepwear acts as a trusted partner to turn innovative eyewear concepts into market-ready products.

The History of Smart Glasses: From Early Prototypes to Everyday Wearables

The evolution of smart glasses reflects how technology and fashion gradually converge. From assistive visual devices in the 1980s to today’s AI-powered eyewear, each era has pushed the limits of what a pair of glasses can do. For Deepwear, understanding this timeline helps guide brands toward practical, design-led innovation — turning ambitious concepts into products people will actually wear.

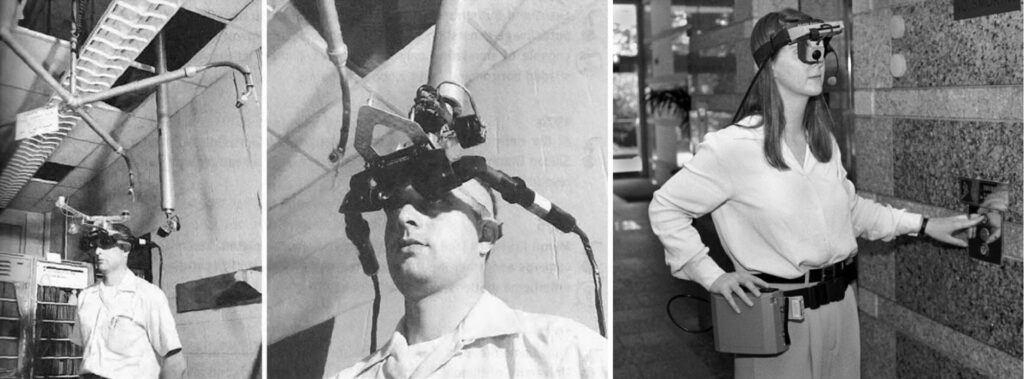

1980s–1990s: Foundations of Wearable Vision

In 1986, researchers developed early “synesthesia concept” smart glasses — devices designed to assist people with visual or hearing impairments by translating sound into light and color. These prototypes demonstrated that eyewear could serve as a non-invasive, body-integrated interface, decades before the term “wearable tech” existed.

The lesson remains relevant today: every successful wearable must begin with a clear purpose. Deepwear can help clients align their product design with human needs — whether improving performance, accessibility, or lifestyle comfort — before entering prototyping and production.

2012–2014: The Google Glass Era

The modern conversation around smart glasses began in 2012, when Google Glass debuted as a hands-free computer integrated into a lightweight frame. It could record video, display notifications, and respond to voice commands, marking the first attempt to bring AR-based eyewear into daily life.

The excitement was short-lived. Users raised privacy and comfort concerns, and the design stood out too much to blend with everyday wear. By 2015, Google Glass was discontinued for consumers and redirected toward enterprise use.

The key takeaway from this era is that technology adoption depends on familiarity and comfort. Smart glasses need to look and feel like normal eyewear. Deepwear’s manufacturing partners can support this through precision prototype development so that integrated hardware (cameras, sensors, or microphones) fits discreetly within aesthetic, wearable frames.

2013–2018: Parallel Developments in Mixed Reality

During the same period, other companies explored professional and entertainment applications. Canon’s MR System (2012) offered a high-end mixed reality experience for industrial design, while startups like Technical Illusions (CastAR) and Atheer Labs experimented with gesture-controlled 3D interfaces.

Meanwhile, Microsoft HoloLens (2016) introduced spatial computing — blending digital and physical space for developers, engineers, and designers. These systems were complex and costly, but they established the groundwork for AR-based smart eyewear.

Such developments underscore how cross-industry collaboration between hardware, optics, and fashion drives innovation. Deepwear can connect brands with optical and materials specialists in Asia to prototype frames suited for lightweight AR modules, combining technical feasibility with scalable manufacturing.

2018–2020: The Return to Everyday Use

After years of enterprise-focused models, brands began simplifying. Intel’s Vaunt (2018) used retinal projection to display text directly on the eye, and Epson’s Moverio line refined transparent displays for both industrial and consumer use.

At the same time, the focus shifted from complex displays to audio functionality, seen in Amazon Echo Frames and Bose Frames, which integrated speakers and microphones while maintaining familiar eyewear design.

This stage proved that practicality drives success, and that fashion-focused design can help wearable tech reach a wider audience. Deepwear can help clients achieve this balance by sourcing sustainable, lightweight materials that support discreet technology integration.

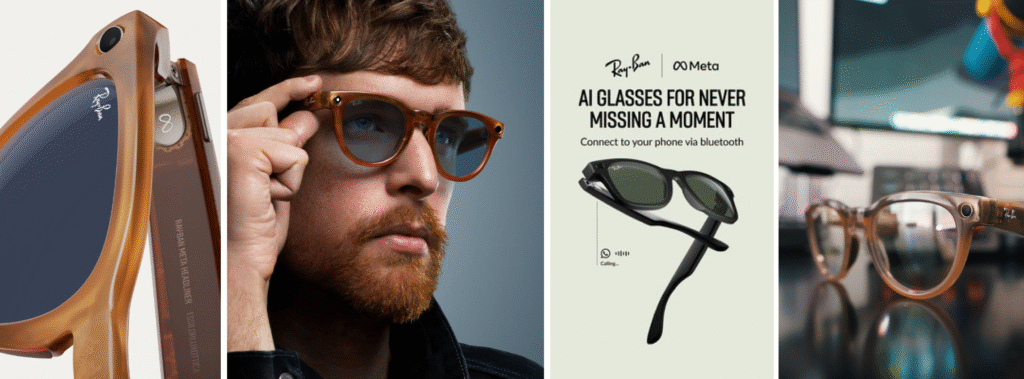

2021–Present: Smart Glasses Meet Lifestyle

By 2021, technology had matured enough for smart glasses to reenter the mainstream. Ray-Ban Meta (formerly Ray-Ban Stories) introduced camera-equipped glasses with built-in speakers and microphones, seamlessly connecting to mobile devices via Bluetooth. Unlike earlier models, they emphasized style, simplicity, and brand familiarity over heavy AR functionality.

Since then, brands like Vuzix, Epson, and Microoled’s Engo Activelook have diversified smart eyewear — targeting sports, healthcare, and creative use. In 2025, Meta announced plans for AI-powered smart glasses capable of display-enabled interaction, signaling another shift toward more intuitive, AI-assisted wearables.

Looking to develop smart eyewear that blends technology, comfort, and design excellence? Deepwear’s consultants can guide you from concept to scalable production.

What This History Teaches Modern Brands

Across decades, one constant remains: successful smart glasses combine usability, design, and timing. From early assistive prototypes to Meta’s AI eyewear, innovation thrives when form and function evolve together.

Deepwear can help brands turn emerging tech into practical fashion products through:

- Material sourcing suited for smart frame integration.

- Prototype development with experienced eyewear manufacturers.

- Flexible production planning as markets and technologies shift.

As the global smart glass market grows from USD 4.65 billion in 2019 to a projected USD 15.79 billion by 2027 (Fortune Business Insights), brands have an opportunity to participate in this expansion through thoughtful, well-designed products. Deepwear can guide that process — from concept to customer-ready innovation.

Explore how artificial intelligence is transforming design processes and making smart clothing more practical and personalized in the fashion industry in our blog: From AI Design to Smart Clothing: How Fashion’s Future Is Taking Shape.

Where to Manufacture Smart Glasses: Deepwear’s Strategic Supply Chain

Manufacturing smart glasses requires a balance of precision engineering and aesthetic craftsmanship — two strengths Deepwear already combines through our production network across China, Vietnam, India, and Thailand.

Below is an overview of what each country offers for producing smart glasses and related components, including estimated 2025 cost ranges.

Prices vary depending on production volume, component quality, and technological complexity.

- China – Core Components and Large-Scale Assembly

China remains the central hub for Deepwear eyewear production, supported by a mature electronics ecosystem and highly developed assembly capabilities. The country produces key modules such as PCBs, Bluetooth chips, camera sensors, and rechargeable batteries at globally competitive prices.

Best for:

- Full assembly of technology-intensive models (camera, audio, AR).

- Component sourcing: lenses, batteries, sensors, microchips.

- Waveguide lens production for AR-based designs (limited but expanding).

Estimated Manufacturing Cost (per unit):

- Audio sunglasses: USD 45–70

- Mid-range smart glasses (camera + connectivity): USD 90–150

- AR display-enabled glasses: USD 200–300+

Deepwear advantage:

China serves as Deepwear’s most reliable base for bulk production, rapid prototyping, and scalable orders. Factories in Shenzhen and Dongguan already produce components for leading wearables and smart eyewear devices, ensuring efficiency from concept to completion.

- Vietnam – Affordable Assembly and Rapid Scaling: Vietnam offers cost-efficient assembly, competitive labor rates, and a growing electronics infrastructure. Many brands are shifting production here to diversify supply chains and manage tariffs while maintaining quality.

Best for:

- Final assembly and cosmetic finishing of frames.

- Plastic injection molding for eyewear parts.

- Packaging and kitting for export markets.

Estimated Manufacturing Cost (per unit):

- Audio sunglasses: USD 35–55

- Camera-enabled smart glasses: USD 75–120

Deepwear advantage:

Deepwear’s established network in Vietnam enables precision assembly combined with fashion finishing, making it suitable for mid-tier smart eyewear that blends technology with style.

- India: India’s electronics sector is expanding rapidly, backed by manufacturing incentives and production-linked subsidies. Low labor and operational costs make it ideal for simpler, high-volume products such as audio-first or camera-free smart glasses.

Best for:

- Basic electronics assembly and casing.

- Bluetooth-enabled audio sunglasses.

- Regional manufacturing for South Asia and the Middle East.

Estimated Manufacturing Cost (per unit):

- Audio sunglasses: USD 25–45

- Smart frames with Bluetooth and sensors: USD 60–90

Deepwear advantage:

Deepwear can leverage India as a cost-efficient hub for mass-market smart eyewear, coordinating with local EMS factories for assembly and electronics integration. This allows Deepwear to help brands deliver competitively priced products that can reach both Asian and Western markets, while maintaining scalability and consistent production standards.

- Thailand: Thailand’s skilled labor, advanced finishing facilities, and proximity to Deepwear’s regional base make it ideal for final assembly, quality assurance, and design integration. It’s also where technology meets fashion — from polishing acetate frames to luxury-grade packaging.

Best for:

- Optical lens polishing and frame assembly.

- Branding, engraving, and packaging for retail.

- Final inspection and export preparation.

Estimated Manufacturing Cost (per unit):

- Audio sunglasses: USD 40–60

- Premium hybrid smart glasses: USD 80–130

Deepwear advantage:

Thailand serves as Deepwear’s main HQ and central hub for final-stage production. Our team can oversee production runs, maintain quality control, and integrate eyewear into broader apparel or accessory collections, ensuring a seamless finishing process for premium or lifestyle smart glasses.

From Concept to Wearable Reality

Smart glasses once seemed like a concept straight out of science fiction, but the last decade has proven they can be practical, stylish, and much more than just entertainment gadgets. Today’s success depends on wearables that feel familiar, integrate seamlessly into daily life, and balance both aesthetics and functionality.

Deepwear is a trusted partner for brands navigating this evolution. With expertise in material sourcing, prototyping, and end-to-end manufacturing, we can help turn innovative concepts into ready-to-wear products. Our network that spans 17 countries can make sure that each stage — from design to final finishing — meets both technical and aesthetic vision.

Ready to turn your smart eyewear vision into a market-ready product? Book a strategy call with Deepwear’s global consultants or explore our smart eyewear sourcing and production solutions today.