While ski markets traditionally peak during winter, the sport is undergoing a transformation. No longer confined to mountain resorts or seasonal holidays, skiing is emerging as a lifestyle—one increasingly defined by mobility, urban play, and all-season adaptability. From Gen Z skaters grinding snowy stairwells in Norway to van life adventurers chasing the last of spring snow in Japan, today’s skiers expect more from their gear.

Here at Deepwear, we see this shift not just as a cultural movement but as a growing product opportunity. Gear that combines slope-ready performance with urban adaptability in both form and function unlocks untapped potential for brands. Imagine skis built for variable terrain, outerwear that merges technical performance with streetwear sensibility, and accessories designed to move effortlessly between mountain resorts and metropolitan streets.

For brands, this means thinking beyond the plateau — literally and figuratively. The demand isn’t disappearing with the snow; it’s shifting to new grounds.

The Future of Ski Gear Is Versatile

The global ski gear and equipment market is gaining steady ground, projected to grow from USD 1.78 billion in 2024 to USD 2.47 billion by 2034, with a 3.3% CAGR, according to Future Market Insights. Much of this growth is powered not only by traditional alpine tourism but by shifting consumer behaviors, emerging regional markets, and the evolution of skiing itself.

Key market drivers include:

- Performance & protection innovations: GPS-equipped helmets, radar-sensitive pants, and 3D-printed boots point to a future where form and function meet safety and speed.

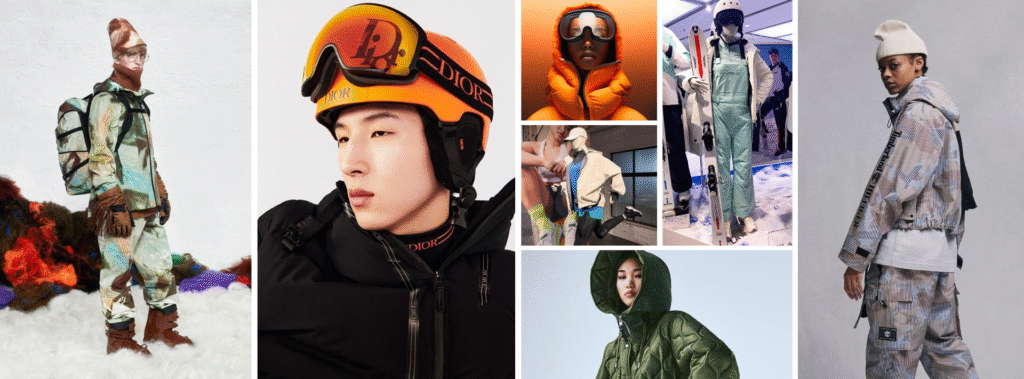

- Lifestyle-led design: Consumers now expect ski gear to reflect their aesthetic values, particularly across streetwear and activewear categories.

- Youth-driven urban skiing: In Northern Europe, Canada, Japan, and Arctic-adjacent cities, Gen Z and millennials are redefining skiing as a street sport. Viral clips of skiers grinding rails, navigating concrete, and tricking off public stairwells are helping the sport break out of its alpine niche.

This expansion from resorts to cities, and from winter-only to shoulder seasons, is reshaping design expectations.

What Makes Good Winter Gear in 2025?

Technical Expertise Is Non-Negotiable. Whether for sport, sub-zero temperatures, or unpredictable terrain, every component must be engineered for performance. This includes:

- Advanced outerwear: Waterproof, breathable, and built to move.

- Multi-use accessories: Helmets, goggles, and gloves optimized for both sport and safety.

- Smart textiles: Moisture-wicking base layers, insulated linings, and windproof seams.

Where to Manufacture Ski Gear and Winter Sportswear

From insulated outerwear to street-ready ski accessories, getting the right production setup is key to staying competitive. The following breakdown highlights some of the best countries to manufacture ski gear and winterwear, based on factory data we’ve reviewed through Deepwear’s sourcing network. While pricing and minimum order quantities (MOQs) can vary depending on the factory, materials, and terms negotiated, these estimates reflect standard industry ranges to help guide your sourcing strategy.

China: China continues to lead the global market in technical apparel and ski gear manufacturing. From waterproof-bonded jackets to insulated gloves and anti-fog goggles, Chinese factories—especially those in Zhejiang and Guangdong—offer unmatched supply chain integration.

- MOQ: 300–500 units (some boutique-friendly factories go as low as 100)

- Cost per jacket: $30–$70* depending on features and materials

- Why it works: Technical materials like GORE-TEX and Thinsulate are readily available, and sampling is fast.

- Watch out for: Rising labor costs and evolving ESG compliance requirements in Western markets.

Vietnam: Vietnam has quietly become the go-to destination for brands seeking performance wear with a lower environmental footprint. Many factories comply with international labor standards and offer bonded seams, water-resistant coatings, and heat-sealed insulation at competitive rates.

- MOQ: 300–600 units

- Cost per jacket: $28–$55*

- Why it works: Clean production, growing technical know-how, and attractive trade agreements with the EU and CPTPP countries.

- Watch out for: Some reliance on fabric imports (often from China) can lengthen lead times.

Turkey: For EU-based brands looking to shorten lead times and avoid hefty tariffs, Turkey offers a winning combination of speed, quality, and technical expertise—especially for lifestyle-infused ski gear that walks the line between performance and fashion.

- MOQ: 200–400 units

- Cost per jacket: $45–$85*

- Why it works: Proximity to Europe, strong technical stitching, and stylish finishes.

- Watch out for: Higher energy and labor costs than Asia, with occasional geopolitical concerns.

What About Accessories?

- Gloves & Goggles: Best made in China, where factories offer heated gloves, touchscreen compatibility, and high-performance anti-fog coatings.

- MOQ: 300–500 pairs

- Price range: $4–$15* per pair

- Helmets & Boots: While China dominates for mass-market styles, premium ski boots and helmets are still best sourced from Italy or Romania if you’re targeting pro-level or luxury consumers.

Match Country to Collection Goals

Each manufacturing country brings something different to the snow table:

- China is unbeatable for one-stop-shop functionality and fast prototyping.

- Vietnam excels in sustainable outerwear production at scale.

- Turkey provides proximity and polish for European buyers.

If your brand is launching a line that combines alpine tech with streetwear sensibility, consider mixing sources: use Vietnam or China for technical shells, India for thermals and urban-style layers, and China again for accessories.

Disclaimer: All cost ranges mentioned are based on industry averages within Deepwear’s sourcing network. Actual pricing may vary depending on the specific factory’s conditions, materials chosen, technical requirements, project specifications, order volume, and country of choice. Brands are encouraged to request detailed quotes and samples before finalizing production.

Scaling for Flexibility, Function, and Style

Production strategies must keep pace with changing consumer behavior and environmental conditions. Manufacturers today face growing demand for gear that performs across a wider range of terrains and climates, while also appealing to younger, style-conscious audiences.

Material Sourcing for Multi-Use Conditions

Modern ski gear must be versatile enough for classic alpine settings, urban environments, and off-season use. This calls for high-quality fabrics and composites that prioritize durability, breathability, and weatherproofing. Innovations like heated fabrics, moisture-wicking base layers, and 3D-printed components are reshaping performance benchmarks while expanding design possibilities.

Adjusting Production Cycles for Extended Seasons

Since skiing is now taking root in cities and shoulder seasons, brands are no longer bound to winter-only schedules. Leading manufacturers are:

- Expanding release timelines to support gear tailored for spring skiing and transitional weather

- Introducing capsule and limited-edition drops that reflect freestyle and street-inspired aesthetics, appealing to Gen Z and millennial skiers

- Experimenting with trend-driven runs to stay responsive to viral culture and shifting use cases

Low MOQs and Customization as a Competitive Advantage

Serving diverse regional markets requires more than manufacturing capacity — it demands strategic agility and design intelligence. At Deepwear, we empower brands to stay ahead by enabling small-batch production, modular development, and low minimum order quantities through our trusted global manufacturing network. This approach allows for market responsiveness, reduces overproduction risk, and supports creative experimentation across varied consumer segments.

The Critical Link Between Vision and Execution

Deepwear is the operational and creative core of our clients’ fashion production journey. We are the critical link that connects concept to consumer — providing end-to-end consultancy services that turn ideas into market-ready collections. From initial design to production and distribution, we help brands build collections that perform across terrain, time zones, and trends.

What We Offer

- Early-stage design development that integrates performance, utility, and street-ready aesthetics

- Precision-built tech packs that reduce friction during sampling and production

- Embedded regional presence in key markets including the US, China, France, Germany, Italy, Bulgaria, and India, ensuring locally attuned execution

How We Create Value

- Direct access to a global network of vetted manufacturers experienced in both alpine and urban gear

- Support for small-batch production and rapid prototyping to meet shifting market demands

- Strategic design and market insights to help brands evolve alongside emerging ski cultures and seasonal shifts

As more consumers demand gear that blurs the line between function and fashion, Deepwear ensures brands don’t just keep up — they lead.

Designing for What’s Next

As skiing evolves from a seasonal sport to a lifestyle movement, the expectations around gear are changing. Consumers want products that perform across terrains, reflect their personal style, and hold up beyond the winter months. From urban rails to extended spring slopes, demand is shifting—creating space for brands to rethink how they design, produce, and release their collections.

At Deepwear, we help brands stay ahead by aligning technical innovation with cultural relevance. With flexible production models, global market insight, and a design-first approach, we’re ready to support your next move. If you’re developing ski gear for today’s diverse users and tomorrow’s trends, let’s make something that works anywhere, anytime.